[et_pb_section fb_built=”1″ _builder_version=”4.18.0″ _module_preset=”default” global_colors_info=”{}”][et_pb_row _builder_version=”4.18.0″ _module_preset=”default” global_colors_info=”{}”][et_pb_column type=”4_4″ _builder_version=”4.18.0″ _module_preset=”default” global_colors_info=”{}”][et_pb_text _builder_version=”4.18.0″ _module_preset=”default” hover_enabled=”0″ global_colors_info=”{}” sticky_enabled=”0″]

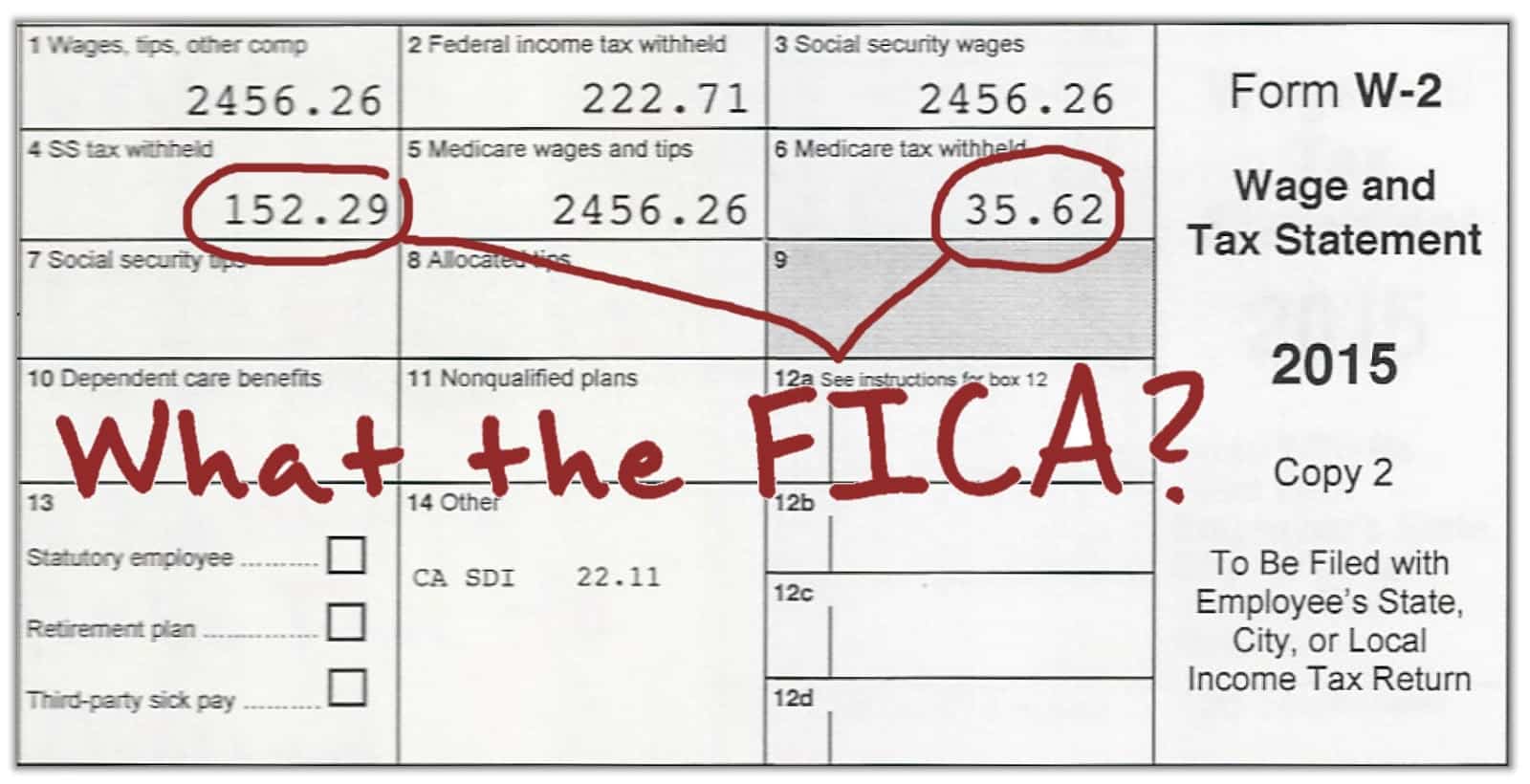

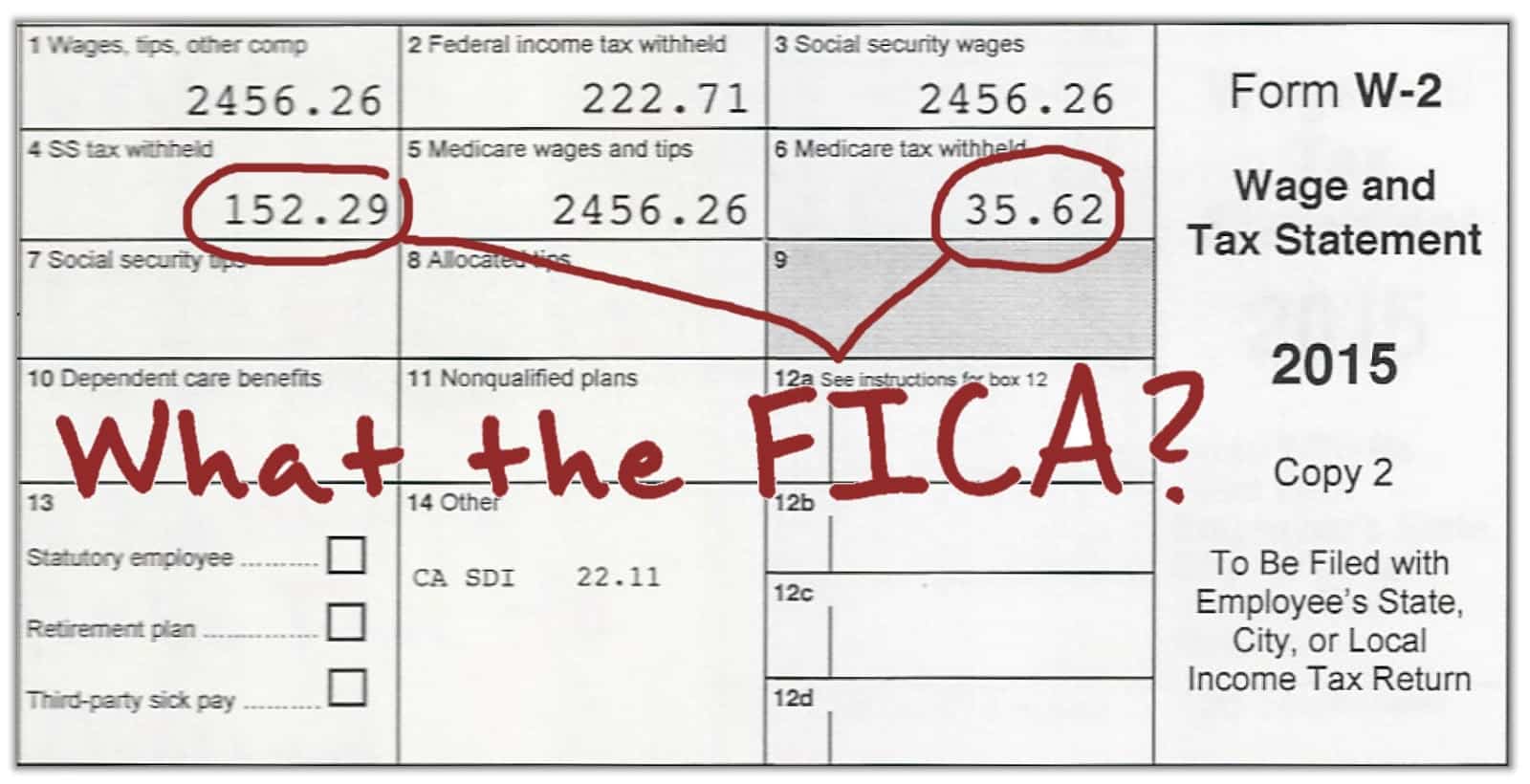

In accordance with the FICA (Federal Insurance Contributions Act), Medicare Social Security tax encompasses all social security taxes and refers to the Old-Age, Survivors, and Disability Insurance (OASDI) programs (OASDI). This withheld tax is sometimes referred to as Medicare taxes. All employees, including non-resident alien employees and students, are required to pay into Social Security.

Every dollar of social security taxes received is used to support the country’s social security system. Even if an employee does not anticipate becoming eligible for Medicare benefits through Social Security, employers in the United States are required to withhold all social security taxes from their employee’s wages, there is no real way for you to exclude yourself from paying PICA taxes. Some people, such as teachers may be exempt because they are not eligible to collect Social Security when they retire.

Social Security tax withholding

FICA taxes are paid by both you and your employer. You pay for half the FICA taxes, and your employer will pay the other half. If you are self-employed, you will need to pay 100% of your FICA taxes. For self-employed individuals, it is best to pay FICA and income taxes on a quarterly basis to avoid paying penalties when filing your taxes in April. If you have questions, we recommend you talk to an accountant on how best to pay your taxes.

2021-2022 FICA tax rates and limits

|

Employee pays |

Employer pays |

| Social Security tax (aka OASDI) |

6.2% (only the first $142,800 in 2021; $147,000 in 2022) |

6.2% (only the first $142,800 in 2021; $147,000 in 2022) |

| Medicare tax |

1.45%. |

1.45%. |

| Total |

7.65% |

7.65% |

| Additional Medicare tax |

0.9% (on earnings over $200,000 for single filers; $250,000 for joint filers) |

|

Many people who do not have to pay Medicare and Social Security tax year round. Every year, the IRS will determine the income ceiling for individuals. The pay ceiling for FICA taxes in 2021 was $142,800, while the wage ceiling in 2022 is $147,000.

[/et_pb_text][/et_pb_column][/et_pb_row][/et_pb_section]