[et_pb_section fb_built=”1″ _builder_version=”4.16″ _module_preset=”default” background_color=”#eef5ff” custom_margin=”||||false|false” custom_padding=”0px||25px||false|false” global_colors_info=”{}”][et_pb_row column_structure=”1_2,1_2″ use_custom_gutter=”on” gutter_width=”1″ make_equal=”on” _builder_version=”4.16″ _module_preset=”default” width=”70%” max_width=”100%” module_alignment=”center” custom_margin=”||||false|false” custom_padding=”||0px||false|false” global_colors_info=”{}”][et_pb_column type=”1_2″ _builder_version=”4.16″ _module_preset=”default” global_colors_info=”{}”][et_pb_text _builder_version=”4.20.4″ _module_preset=”default” text_font_size=”22px” header_font=”||on|on|||||” header_2_font_size=”45px” custom_margin=”10%||25px||false|false” custom_padding=”|15px|||false|false” global_colors_info=”{}”]

Insurance Purse, the comparison site that puts money back in your pocket

Save money and protect your family at the same time. We work with a large network of insurance companies and agents to save you the most money on all your insurance needs. Our partners are trained to find you all available discounts.

[/et_pb_text][et_pb_code _builder_version=”4.21.0″ _module_preset=”default” custom_margin=”||||false|false” custom_padding=”20px||||false|false” hover_enabled=”0″ global_colors_info=”{}” sticky_enabled=”0″]

[/et_pb_code][/et_pb_column][et_pb_column type=”1_2″ _builder_version=”4.16″ _module_preset=”default” global_colors_info=”{}”][et_pb_image src=”https://blog.insurancepurse.com/wp-content/uploads/2022/08/family_happy.png” title_text=”family_happy” _builder_version=”4.21.0″ _module_preset=”default” hover_enabled=”0″ global_colors_info=”{}” force_fullwidth=”on” custom_padding=”||||false|false” custom_margin=”20px||||false|false” sticky_enabled=”0″][/et_pb_image][/et_pb_column][/et_pb_row][/et_pb_section][et_pb_section fb_built=”1″ _builder_version=”4.16″ _module_preset=”default” min_height=”90px” custom_margin=”-70px||-30px||false|false” custom_padding=”||0px|||” global_colors_info=”{}”][/et_pb_section][et_pb_section fb_built=”1″ disabled_on=”on|on|off” _builder_version=”4.20.4″ _module_preset=”default” width=”90%” module_alignment=”center” global_module=”2150″ global_colors_info=”{}”][et_pb_row column_structure=”1_2,1_2″ _builder_version=”4.21.0″ _module_preset=”default” width=”70%” max_width=”100%” global_colors_info=”{}”][et_pb_column type=”1_2″ _builder_version=”4.16″ _module_preset=”default” global_colors_info=”{}”][et_pb_text _builder_version=”4.20.4″ _module_preset=”default” text_font=”||||||||” global_colors_info=”{}”]

Review & Possibly Save on Your Insurance

[/et_pb_text][/et_pb_column][et_pb_column type=”1_2″ _builder_version=”4.16″ _module_preset=”default” global_colors_info=”{}”][et_pb_text _builder_version=”4.20.4″ _module_preset=”default” width=”80%” global_colors_info=”{}”]

Call Us To Possibly Save

Speak to a licensed insurance agent.

[/et_pb_text][et_pb_text _builder_version=”4.21.0″ _module_preset=”default” custom_padding=”||0px|||” global_colors_info=”{}”]

Our Licensed Insurance Agents Could Give You a Plan Review in Minutes

Our licensed insurance agents will help review plans for your budget and needs.

[/et_pb_text][/et_pb_column][/et_pb_row][/et_pb_section][et_pb_section fb_built=”1″ _builder_version=”4.16″ _module_preset=”default” background_color=”#eef5ff” global_colors_info=”{}”][et_pb_row _builder_version=”4.16″ _module_preset=”default” global_colors_info=”{}”][et_pb_column type=”4_4″ _builder_version=”4.16″ _module_preset=”default” global_colors_info=”{}”][et_pb_text _builder_version=”4.16″ _module_preset=”default” global_colors_info=”{}”]

Recent Insurance Guides & Articles.

Insurance Purse is here to answer any of your tough

insurance questions.

[/et_pb_text][/et_pb_column][/et_pb_row][et_pb_row use_custom_gutter=”on” gutter_width=”2″ make_equal=”on” _builder_version=”4.16″ _module_preset=”default” width=”70%” max_width=”100%” module_alignment=”center” global_colors_info=”{}”][et_pb_column type=”4_4″ _builder_version=”4.16″ _module_preset=”default” global_colors_info=”{}”][et_pb_blog fullwidth=”off” posts_number=”6″ include_categories=”9″ show_more=”on” show_author=”off” show_categories=”off” _builder_version=”4.17.1″ _module_preset=”default” custom_css_title=” font-weight: bold;|| font-size: 24px;|| line-height: 150%;|| display: flex;|| align-items: flex-end;|| letter-spacing: -0.005em;|| color: #3d3d3d;|| padding-bottom: 5px;” custom_css_content=” font-style: normal;|| font-weight: 450;|| font-size: 16px;|| line-height: 150%;|| letter-spacing: -0.005em;|| color: #898a8e;|| padding-bottom: 5px;” custom_css_featured_image=”border-radius:10px;||” custom_css_read_more=”|| border-radius: 6px;|| background-color: #2a7bfe;transition: all 300ms ease 0ms;color: #fff!important;||padding:10px;||margin-top:10px !important;||text-transform:capitalize;||display:inline-block;” global_colors_info=”{}”][/et_pb_blog][et_pb_code _builder_version=”4.16″ _module_preset=”default” global_colors_info=”{}”]

[/et_pb_code][/et_pb_column][/et_pb_row][/et_pb_section][et_pb_section fb_built=”1″ _builder_version=”4.21.0″ _module_preset=”default” hover_enabled=”0″ global_colors_info=”{}” disabled_on=”on|off|off” sticky_enabled=”0″][et_pb_row admin_label=”Row” _builder_version=”4.16″ _module_preset=”default” width=”70%” max_width=”100%” global_colors_info=”{}”][et_pb_column type=”4_4″ admin_label=”Column” _builder_version=”4.16″ _module_preset=”default” global_colors_info=”{}”][et_pb_tabs admin_label=”Tabs” module_class=”vertical-tabs1″ _builder_version=”4.16″ _module_preset=”default” custom_margin=”9px|||||” custom_padding=”2px|||||” custom_css_tab=”||font-style: normal;||font-weight: 450;||font-size: 18px;||line-height: 150%;||/* identical to box height, or 27px */||||display: flex;||align-items: flex-end;||letter-spacing: -0.005em;||||color: #3D3D3D;” custom_css_active_tab=”||font-style: normal !important;||font-weight: bold !important;||font-size: 18px !important;||line-height: 150% !important;||/* identical to box height, or 27px */||||display: flex !important;||align-items: flex-end !important;||letter-spacing: -0.005em !important;||||/* #2A7BFE */||||color: #2A7BFE !important;||border-left: 2px solid #2A7BFE !important;” custom_css_tabs_content=”font-style: normal;||font-weight: 450;||font-size: 16px;||line-height: 150%;||/* or 24px */||||letter-spacing: -0.005em;||||color: #898A8E;” global_colors_info=”{}”][et_pb_tab title=”Basic Terms to Know” _builder_version=”4.16″ _module_preset=”default” global_colors_info=”{}”]

Car Insurance: Basic Terms to Know

|

If you have a loss that is covered by the terms of your car insurance, you can file an insurance claim with your insurance company for coverage, compensation or for representation if you are liable for damages.

|

A deductible is the amount you need to pay before your insurance company begins to pay for your damages or loss. You choose the deductible amount when you buy insurance.

|

|

The premium is the amount you agree to pay in exchange for protection from an insurance company. Annual and monthly payments are how most people pay for insurance. Others pay semi-annually or quarterly.

|

A liability, in general, is an obligation to, or something you owe someone, as a legal financial debt. Liability insurance protects you against legal costs and payouts you would otherwise be responsible to pay out-of-pocket.

|

[/et_pb_tab][et_pb_tab title=”Car Insurance Coverage” _builder_version=”4.16″ _module_preset=”default” global_colors_info=”{}”]

Car Insurance Coverage: Simplified

|

This form of coverage is required in every state. It covers bodily injuries to a third party in an accident that was deemed your fault.

|

This form of coverage is required in every state. It covers property damage and loss of use to a third party.

|

|

Drivers in the US have a lot of options when it comes to car insurance. With hundreds of companies.

|

How much is car insurance for your vehicle? Your make and model are one of the biggest factors in determining the price you pay.

|

[/et_pb_tab][et_pb_tab title=”Factors that Affect Rates” _builder_version=”4.16″ _module_preset=”default” global_colors_info=”{}”]

Factors that Affect Car Insurance Rates

|

Certain parts of your profile affect your car insurance rates more than others, and every insurer has their own specific formula to decide how much risk you pose. The following are the most heavily weighted factors used to determine car insurance rates:

|

| Location | Location | Location |

| Location | Location | Location |

| Location | Location | Location |

| Location | Location | Location |

| Location | Location | Location |

Compare Auto Insurance by Geographical LocationEach state has different requirements. Some only require liability insurance whereas “no-fault’ states require drivers to carry personal injury protection, also called PIP.

|

State RequirementsEach state has different requirements. Some only require liability insurance whereas “no-fault’ states require drivers to carry personal injury protection, also called PIP.

|

Car Insurance by Vehicle TypeEach state has different requirements. Some only require liability insurance whereas “no-fault’ states require drivers to carry personal injury protection, also called PIP.

|

Car Insurance Rates Based on Driving Records |

A history of car crashes, a couple of cars stolen and some DUIs will raise your rates. However, if you have no incidents within a given year, your rate may drop.

| State | High Risk Drivers | Safe Drivers* |

| Alaska | $123.25 | $98.23 |

|---|---|---|

| Arkansas | $130.49 | $116.18 |

| Colorado | $123.21 | $139.04 |

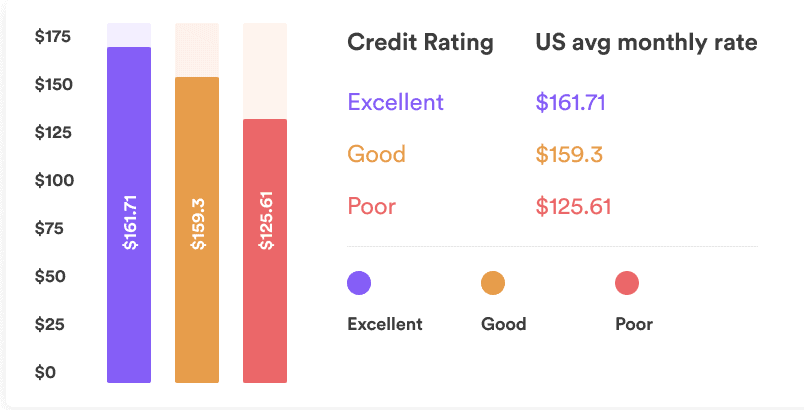

US Average Car Insurance Rates by Credit Score |

Some states do not use credit scores to determine car insurance rates while others do.

How Important is Driving Experience?The number of years you have been driving will affect your rate, so if you avoid filing claims (and accidents), your rate should decrease over time. With experience, drivers make fewer mistakes that lead to collisions and theft.

|

What is your Garaging Address?Your location is also a big determining factor for your auto insurance rate. Your zip code tells a car insurance carrier how prone you are to floods, crime, wildfires, and other perils that may cause damage or loss of your vehicle.

|

Marital Status Influence Car Insurance CostsEven if you have poor credit or a terrible credit score, SmartFinancial can help you find the best coverage in Virginia.

|

Vehicle History Factor on Insurance RatesThe number of times a vehicle has traded hands and the type of car ownership also affect insurance rates. In other words, your rates vary according to whether your car is owned, leased or financed.

|

Does Gender Affect Car Insurance Price?Most states still use gender as a determining factor in setting car insurance rates. While most people assume that male teens pay the highest car insurance rates, the truth is that rates vary depending on the carrier.

|

Coverage History and Car Insurance PremiumContinuous coverage is one of the most important factors used to determine vehicle insurance rates.

|

[/et_pb_tab][et_pb_tab title=”How to Compare Auto Insurance” _builder_version=”4.16″ _module_preset=”default” global_colors_info=”{}”]

Insurance Purse Compares Rates with the Following Insurance Companies

|

Using innovative technology built by insurance experts, we provide the tools insurers need to grow and drive the bottom line! As the leader in customer acquisition technology, our success speaks for itself.

|

List of Car Insurance Companies

| Company Name | Company Name | Company Name |

| Company Name | Company Name | Company Name |

| Company Name | Company Name | Company Name |

[/et_pb_tab][/et_pb_tabs][/et_pb_column][/et_pb_row][/et_pb_section][et_pb_section fb_built=”1″ _builder_version=”4.16″ _module_preset=”default” background_color=”#eef5ff” global_colors_info=”{}”][et_pb_row _builder_version=”4.16″ _module_preset=”default” global_colors_info=”{}”][et_pb_column type=”4_4″ _builder_version=”4.16″ _module_preset=”default” global_colors_info=”{}”][et_pb_text _builder_version=”4.16″ _module_preset=”default” global_colors_info=”{}”]

Insurance Articles

[/et_pb_text][/et_pb_column][/et_pb_row][et_pb_row column_structure=”1_4,1_4,1_4,1_4″ use_custom_gutter=”on” gutter_width=”1″ make_equal=”on” _builder_version=”4.16″ _module_preset=”default” max_width=”100%” custom_padding=”|25px||25px|false|false” global_colors_info=”{}”][et_pb_column type=”1_4″ _builder_version=”4.16″ _module_preset=”default” custom_padding=”|25px|||false|false” border_width_right=”1px” global_colors_info=”{}”][et_pb_text _builder_version=”4.16″ _module_preset=”default” global_colors_info=”{}”]

SR22 Insurance: Texas Laws and Requirements.

SR-22 insurance policies give Texans with not-so-perfect driving records a second chance to get back on the state’s highways.

SR-22 insurance policies give Maret 01, 2021

![]() Marina Sans

Marina Sans

Agent Senior[/et_pb_text][et_pb_text _builder_version=”4.16″ _module_preset=”default” custom_margin=”25px||||false|false” custom_padding=”25px||||false|false” border_width_top=”1px” global_colors_info=”{}”]

Is it Possible To Get Cheap Auto Insurance in VA?

By David Yang O’Connel

[/et_pb_text][/et_pb_column][et_pb_column type=”1_4″ _builder_version=”4.16″ _module_preset=”default” custom_padding=”|25px||25px|false|true” global_colors_info=”{}”][et_pb_image src=”https://blog.insurancepurse.com/wp-content/uploads/2021/12/Mask-Group-16.png” title_text=”Mask Group (16)” align=”center” force_fullwidth=”on” _builder_version=”4.16″ _module_preset=”default” custom_padding=”||||false|false” global_colors_info=”{}”][/et_pb_image][et_pb_text _builder_version=”4.16″ _module_preset=”default” custom_margin=”15px||||false|false” global_colors_info=”{}”]

Allstate Drivewise Reviews in Alabama

SR-22 insurance policies give Texans with not-so-perfect Costco sells auto and home policies and more. Here’s everything you need to know about Costco auto insurance and how to beat their rates. Let’s dive in! records a second chance to get back on the state’s highways. SR-22 insurance policies give Texans with not-so-perfect driving records a second chance to get back on the state’s highways.

![]() Ellen Maryati

Ellen Maryati

Agent Senior

[/et_pb_text][/et_pb_column][et_pb_column type=”1_4″ _builder_version=”4.16″ _module_preset=”default” custom_padding=”|25px||25px|false|true” border_width_left=”1px” global_colors_info=”{}”][et_pb_image src=”https://blog.insurancepurse.com/wp-content/uploads/2021/12/Mask-Group-12.png” title_text=”Mask Group (12)” _builder_version=”4.16″ _module_preset=”default” global_colors_info=”{}”][/et_pb_image][et_pb_text _builder_version=”4.16″ _module_preset=”default” custom_margin=”15px||||false|false” global_colors_info=”{}”]

Is it Possible To Get Cheap Auto Insurance in VA?

By David Yang O’Connel

[/et_pb_text][et_pb_image src=”https://blog.insurancepurse.com/wp-content/uploads/2021/12/Mask-Group-10.png” title_text=”Mask Group (10)” _builder_version=”4.16″ _module_preset=”default” custom_margin=”15px||||false|false” global_colors_info=”{}”][/et_pb_image][et_pb_text _builder_version=”4.16″ _module_preset=”default” custom_margin=”15px||||false|false” global_colors_info=”{}”]

What Does DWI Mean?

By David Yang O’Connel

[/et_pb_text][/et_pb_column][et_pb_column type=”1_4″ _builder_version=”4.16″ _module_preset=”default” custom_padding=”|||25px|false|false” border_width_left=”1px” global_colors_info=”{}”][et_pb_text _builder_version=”4.16″ _module_preset=”default” custom_margin=”25px||||false|false” custom_padding=”25px||||false|false” global_colors_info=”{}”]

Is it Possible To Get Cheap Auto Insurance in VA?

By David Yang O’Connel

[/et_pb_text][et_pb_text _builder_version=”4.16″ _module_preset=”default” custom_margin=”15px||||false|false” custom_padding=”15px||||false|false” border_width_top=”1px” global_colors_info=”{}”]

SR22 Insurance: Texas Laws and Requirements.

SR-22 insurance policies give Texans with not-so-perfect driving records a second chance to get back on the state’s highways.

SR-22 insurance policies give Maret 01, 2021

![]() Marina Sans

Marina Sans

Agent Senior

[/et_pb_text][/et_pb_column][/et_pb_row][/et_pb_section][et_pb_section fb_built=”1″ _builder_version=”4.21.0″ _module_preset=”default” background_color=”#f9f9fc” hover_enabled=”0″ global_module=”902″ saved_tabs=”all” global_colors_info=”{}” disabled_on=”on|off|off” sticky_enabled=”0″][et_pb_row module_id=”foorRowWithLogo” _builder_version=”4.16″ _module_preset=”default” global_colors_info=”{}”][et_pb_column type=”4_4″ _builder_version=”4.16″ _module_preset=”default” global_colors_info=”{}”][et_pb_code admin_label=”Code” module_id=”footerRowBigMenu” _builder_version=”4.20.4″ _module_preset=”default” global_colors_info=”{}”]

Compare Quotes Instantly.

Enter your zip code, answer a few questions, and compare insurance quotes online in less than 3 min.

[/et_pb_code][et_pb_code module_id=”footerRowDivider” _builder_version=”4.16″ _module_preset=”default” global_colors_info=”{}”]1[/et_pb_code][et_pb_code admin_label=”Code” _builder_version=”4.16″ _module_preset=”default” global_colors_info=”{}”]

[/et_pb_code][/et_pb_column][/et_pb_row][/et_pb_section][et_pb_section fb_built=”1″ fullwidth=”on” _builder_version=”4.16″ _module_preset=”default” global_colors_info=”{}”][et_pb_fullwidth_code admin_label=”Fullwidth Code” module_id=”quotesFooterText” _builder_version=”4.16″ _module_preset=”default” custom_css_main_element=”text-align:center;||font-style: normal;||font-weight: 450;||font-size: 15px;||line-height: 19px;||letter-spacing: -0.204545px;||margin-bottom:40px;||color: #3D3D3D;” global_colors_info=”{}”]Copyright © 2020. InsurancePurse.com. All rights reserved.[/et_pb_fullwidth_code][/et_pb_section]