Medicare

How Much Will Medicare Supplemental Cost?

Typically, you pay a monthly premium for Medicare coverage plus a portion of the cost each time you use a covered service. There is no annual deductible limit unless you have additional insurance, such as being associated with a Medicare Supplement Insurance (Medigap) policy or Medicare Advantage plan.

[et_pb_section fb_built=”1″ _builder_version=”4.15″ _module_preset=”default” global_colors_info=”{}”][et_pb_row _builder_version=”4.15″ _module_preset=”default” global_colors_info=”{}”][et_pb_column type=”4_4″ _builder_version=”4.15″ _module_preset=”default” global_colors_info=”{}”][et_pb_text _builder_version=”4.15.1″ _module_preset=”default” hover_enabled=”0″ global_colors_info=”{}” sticky_enabled=”0″]

How Much Will Medicare Supplemental Cost?

Typically, you pay a monthly premium for Medicare coverage plus a portion of the cost each time you use a covered service. There is no annual deductible limit unless you have additional insurance, such as being associated with a Medicare Supplement Insurance (Medigap) policy or Medicare Advantage plan.

What You Pay for Part A (Hospital Insurance)

| Part A costs: | What you pay in 2022: |

| Premium |

Most people will pay $0 because they paid Medicare taxes for at least ten years while employed. People will often refer to this as “premium-free Part A.” Do I qualify for Part A? If you are not entitled to free Premium Part A, you can usually purchase it. In 2022, the premium could be as low as $ 274 or $ 499 a month. The cost will depend on how long you or your spouse worked and paid Medicare taxes. |

| Deductible | You will need to pay the first $1,556 each time you are admitted to a hospital during the payout period before Original Medicare begins to pay. There is no limit to the number of benefit periods. |

| Inpatient stays (your copayment) |

Days 1-60: $0 after you pay your Part A deductible Days 61-90: $389 per day Days 91-150: $778 each day while you are using your 60 lifetime reserve days After day 150: You pay all costs associated with your stay. |

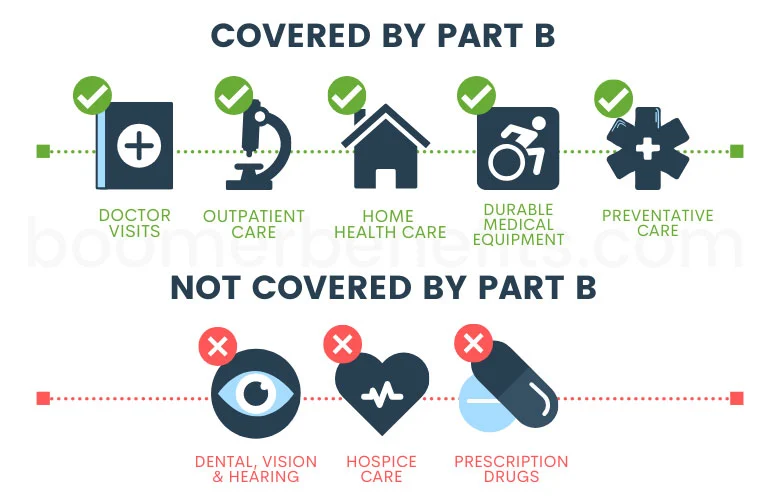

What You Pay for Part B (Medical Insurance)

| Part B costs: | What you pay 2021: |

|

Premium

|

Your cost will start at $170.10 per month, depending on your yearly income). Your cost will vary by year, depending on your income and market changes. You will need to pay your monthly premium even if you don’t receive any covered services. If you don’t sign up for Part B when you are first eligible for Medicare, you may need to pay a penalty. How do I calculate my Part B late enrollment penalty?

|

| Deductible | Your Original Medicare deductible will be $233. The deductible will reset every year. |

| Your Coinsurance | Your coinsurance will usually be 20% for the cost of every Medicare Covered service after you meet your deductible. |

Do You Need Help with Your Part B Coverage?

You may qualify for financial help for your home state if you have a low income. Your state can help you pay the premiums and other costs such as copay, coinsurance, and your deductible.

Your Cost for Supplemental coverage

Drug coverage (Part D):

| Part D costs: | What you pay: |

| Premium |

Your premium will depend on what plan you purchase and will vary from year to year. You may need to pay a penalty if you didn’t purchase a Medicare drug plan when you first qualified for Medicare, and

What is my Part D penalty?

|

| Any time you buy a covered prescription. | The majority of available plans will charge you a deductible for any prescription you buy. The deductible will depend on what plan you buy. Your prescription cost will depend on the prescriptions you buy, the pharmacy you use, and if the prescriptions are covered under your plan. |

Medicare Advantage Plan (Part C):

- Your monthly premiums will depend on the plan you chose. Your cost will change year to year depending on your insurance plan and market prices.

- Your Coinsurance/Copayments/Deductibles will depend on the plan you chose to buy.

- Each plan will have a max out-of-pocket limit. Once you have reached this limit, your insurance company will pay for 100% of call healthcare costs for the remainder of the year.

Medicare Supplement Insurance (Medigap):

- The total cost for this insurance will depend on several things, like where you live, the insurance company you chose, etc.

- This coverage will help reduce your share of the costs for your Part A/B and may even cover healthcare costs when you leave the country.

[/et_pb_text][/et_pb_column][/et_pb_row][/et_pb_section][et_pb_section fb_built=”1″ disabled_on=”on|on|off” _builder_version=”4.14.7″ _module_preset=”default” module_alignment=”center” global_module=”116″ saved_tabs=”all” global_colors_info=”{}”][et_pb_row _builder_version=”4.15″ _module_preset=”default” global_colors_info=”{}”][et_pb_column type=”4_4″ _builder_version=”4.15″ _module_preset=”default” global_colors_info=”{}”][et_pb_text _builder_version=”4.15″ _module_preset=”default” global_colors_info=”{}”]

|

Insurance in Your StateTerms of Services | Privacy Policy |

Company Information Home Career About Us Contact Us Do not sell my personal information Are you an agent? |

Insurance Quotes Auto Insurance Home Insurance Life Insurance Medicare Health Insurance Commercial Insurance |

Resources Find Agent Insurance by State Insurance Companies Compare Companies Renters Insurance |

Get In Touch 855-214-2291 1901 Newport Blvd. Lorem, CA 91754 |

[/et_pb_text][/et_pb_column][/et_pb_row][/et_pb_section]