[et_pb_section fb_built=”1″ _builder_version=”4.22.1″ _module_preset=”default” global_colors_info=”{}”][et_pb_row _builder_version=”4.22.1″ _module_preset=”default” global_colors_info=”{}”][et_pb_column type=”4_4″ _builder_version=”4.22.1″ _module_preset=”default” global_colors_info=”{}”][et_pb_text _builder_version=”4.22.1″ _module_preset=”default” global_colors_info=”{}”]

Insurance Plans

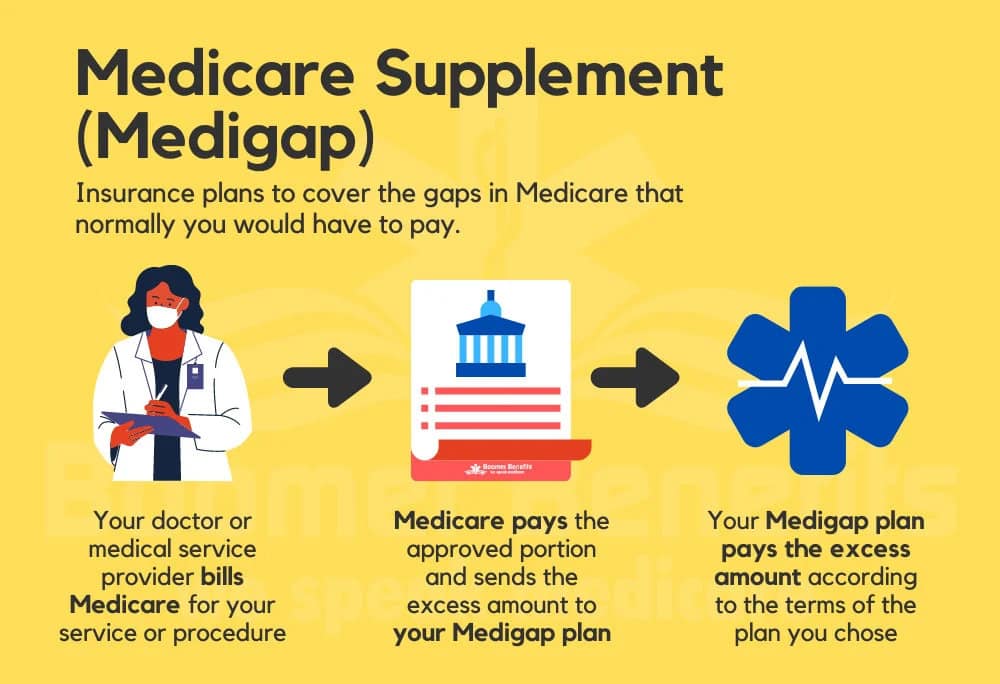

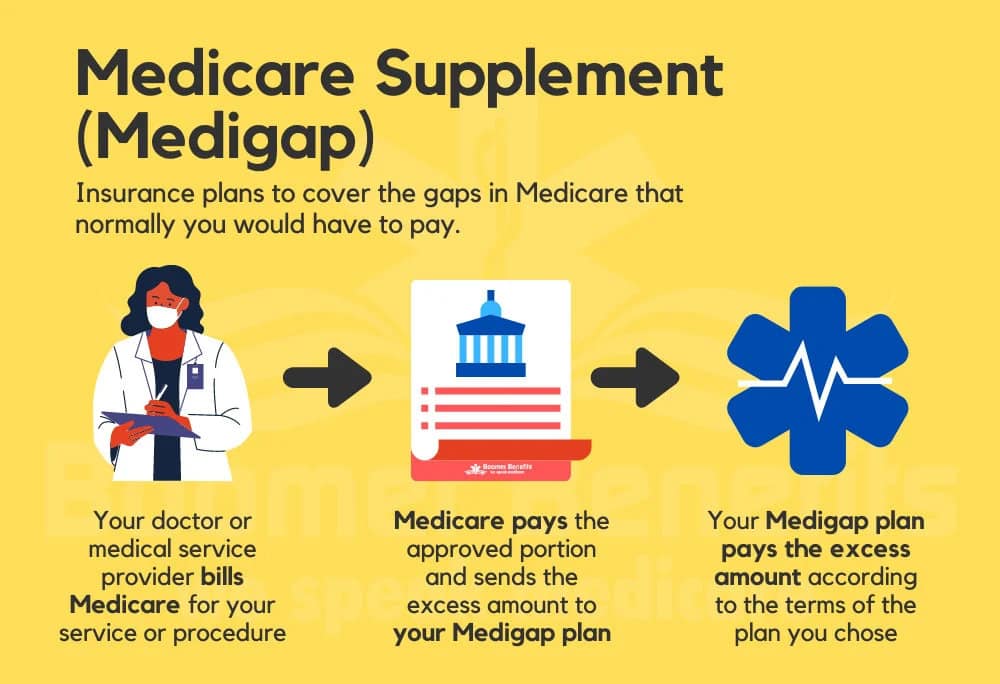

Learn how to Compare Medicare Supplement Insurance Plans. Medicare Supplement Insurance Plans, or Medigap plans, are crucial in helping individuals cover the gaps left by Original Medicare. Understanding and comparing these plans can be overwhelming, but worry not – this comprehensive guide will walk you through the critical aspects of different Medigap plans, enabling you to make an informed decision that suits your healthcare needs and budget.

Why Medigap Plans Matter

Before diving into the intricacies of comparing Medigap plans, let’s first grasp why they are essential. Medicare Part A and Part B offer substantial coverage. However, there are gaps and out-of-pocket expenses for which beneficiaries are still responsible. These gaps can include deductibles, coinsurance, and copayments. This is where Medigap plans come in, as they are designed to supplement your Original Medicare coverage, reducing your financial burden when you receive medical services.

Understanding how Compare Medicare Supplement Insurance Plans.

Medigap plans are standardized and regulated by federal and state laws, ensuring that Plan A from one insurance provider offers the same coverage as Plan A from another. Currently, 10 standardized plans are available, each labeled with a letter (A, B, C, D, F, G, K, L, M, and N). The benefits for each plan are uniform across insurance companies, though the premiums they charge may differ. As of January 1, 2020, Medigap plans that cover the Part B deductible, such as Plan C and Plan F, are no longer available for newly eligible Medicare beneficiaries.

Comparing Medigap Plans: Key Factors to Consider

Several factors should be on your radar when you Compare Medicare Supplement Insurance Plans to ensure the plan aligns with your healthcare needs and budget.

Coverage OfferedMedigap plans are designated by letters, each corresponding to a specific set of benefits. For instance, Plan F offers more comprehensive coverage than Plan A, including a range for Part B excess charges. Assessing your medical needs and anticipated expenses will help determine which coverage suits you.

Premium Costs

Premiums for Medigap plans can vary widely based on your location, age, gender, and the insurance company you choose. While the coverage for a specific plan is standardized, the premium amounts are not. Obtaining quotes from various insurers is advisable to find a plan that fits your budget.

Enrollment Periods

Medigap plans have specific enrollment periods, which are crucial to understand. The best time to enroll is during your Medigap Open Enrollment Period, which starts on the first day of the month you turn 65 and are enrolled in Medicare Part B. During this period, insurance companies are generally prohibited from denying you coverage or charging higher premiums based on your health status.

Out-of-Pocket Costs

In addition to premiums, you must consider out-of-pocket costs such as deductibles and coinsurance. Some Medigap plans cover these costs, while others do not. Understanding how each plan handles these expenses can significantly impact your healthcare expenses.

Provider Network

Unlike Medicare Advantage plans, Medigap plans don’t have provider networks. This means you can see any healthcare provider who accepts Medicare patients. You don’t need referrals or prior authorizations to see specialists, giving you more freedom in choosing your healthcare providers.

Narrowing Down Your Options and Compare Medicare Supplement Insurance Plans

With a clear understanding of the critical factors, it’s time to narrow your options and find the Medigap plan that suits you best.

Assess Your Healthcare Needs

Start by evaluating your current and anticipated healthcare needs. Do you have specific medical conditions that require frequent visits to specialists? Are you on multiple medications? These factors can influence which coverage will be most cost-effective for you.

Estimate Your Costs

Consider your budget and how much you will spend on healthcare each month. While comprehensive coverage might seem appealing, finding a balance between coverage and affordability is essential.

Making an Informed Decision

Comparing Medicare Supplement Insurance Plans can feel like navigating a maze. Still, armed with the correct information, you can make a decision that provides financial security and peace of mind. Remember, the best plan for you may not be the same as your friend or family member’s – it’s a personal choice that hinges on your unique circumstances.

Consulting the Experts

If you find comparing Medigap plans overwhelming or have specific questions, don’t hesitate to seek assistance. State Health Insurance Assistance Programs (SHIPs) offer free, unbiased guidance on Medicare-related matters, including Medigap plans. Additionally, insurance agents specializing in Medicare can provide valuable insights tailored to your situation.

Final Thoughts

Choosing the right Medigap plan is an important decision that can impact your healthcare and finances for years. By understanding the basics of Medigap plans, comparing coverage and costs, and taking advantage of available resources, you’ll be well-equipped to make an informed choice that suits your needs and preferences. Remember, it’s never too early to start researching and comparing plans to ensure a seamless transition into your Medicare coverage.

[/et_pb_text][/et_pb_column][/et_pb_row][/et_pb_section]