[et_pb_section fb_built=”1″ theme_builder_area=”post_content” _builder_version=”4.19.5″ _module_preset=”default”][et_pb_row _builder_version=”4.19.5″ _module_preset=”default” theme_builder_area=”post_content”][et_pb_column _builder_version=”4.19.5″ _module_preset=”default” type=”4_4″ theme_builder_area=”post_content”][et_pb_text _builder_version=”4.19.5″ _module_preset=”default” theme_builder_area=”post_content” hover_enabled=”0″ sticky_enabled=”0″]

How & Why to Compare Insurance Rates

To save the most money on insurance, shop around. Compare Insurance Companies Rates to find the best insurance policy. When you Compare Insurance Companies Rates, it is crucial to ensure you get the most value for your money. You will receive quotations from various insurance providers since they consider comparable factors but assign different degrees of importance.

There are a variety of approaches to assessing risk among insurance companies; each company takes into account various characteristics of stake. Every company tries to conceal as much of its operation as possible.

How to Compare Insurance Companies Rates?

Here are some helpful ideas to consider to Compare Insurance Companies Rates:

- First, determine the level of protection that you require.

- Second, conduct research on service to customers.

- Third, check out your options for coverage and any available discounts.

- Comparison shop for identical amounts of coverage.

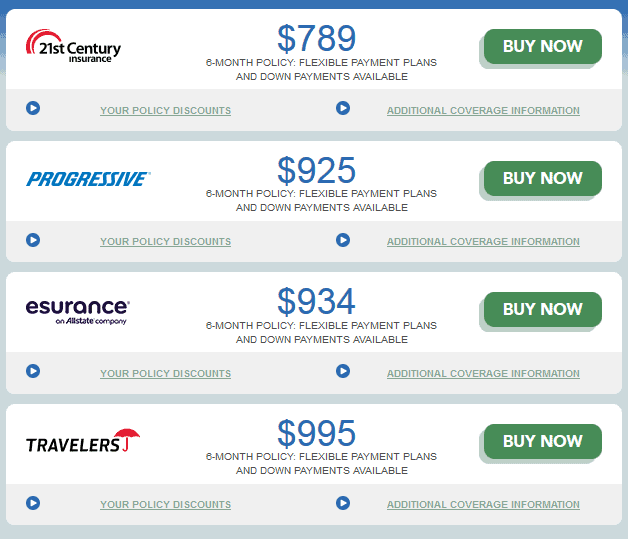

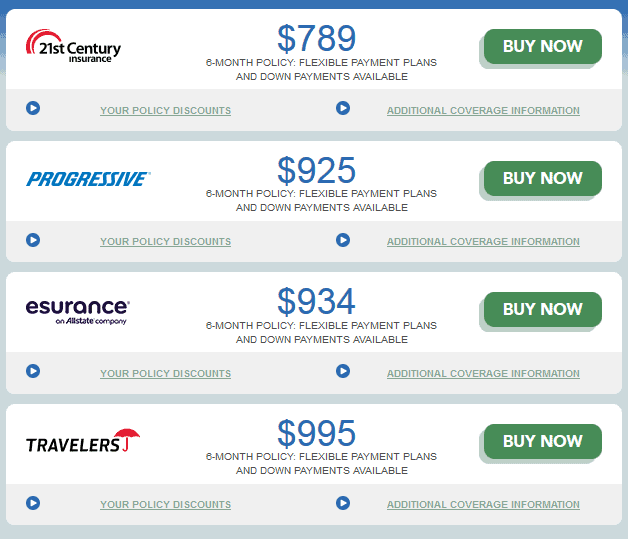

Compare Insurance Companies Rates 2023

When making a price comparison for insurance, one of the most important things to do is gather as many alternatives as possible to identify the insurance providers that offer the best policies. After doing so, you will be able to make an informed selection.

Compare auto insurance rates:

- Based on company

- Based on age

- Based on gender

- Based on state

- For seniors

How to Compare Insurance Companies Rates-Medicare

Because everyone is different, you will need to consider your health requirements, your budget, the doctors you have chosen, and any prescriptions you now use. The tactic that is most successful for you may be less successful for your partner, other members of your family, or other people in your circle of friends.

When performing a comparison of the various Medicare Advantage plans, you should take into consideration the following factors:

- Monthly premiums

- Annual deductibles

- Initial coverage and out-of-pocket limits

- Extra benefits

- Prescription drug coverage

- Provider network

- Star rating

How to Compare Auto Insurance Quotes

It Comes as a Pleasant Shock to Many People to Learn That Receiving an Automobile Insurance Quote Does Not Involve Any Fees. One of the reasons that could discourage customers from shopping for coverage is the widespread belief that requesting estimates will result in further financial outlays on their part.

When comparing several estimates for the cost of auto insurance, here are some considerations to keep in mind:

- Establish the minimum and maximum levels of protection that are acceptable to you.

Consider whether you need collision insurance coverage for your vehicle, and set a deductible accordingly.

- Carry out a study on providing service to clients.

To find an insurance provider that meets your needs, it’s a good idea to look into the feedback they’ve received from previous customers. The next step is to choose a company that specializes in the type of coverage that will best meet your needs.

- Investigate the different kinds of insurance and savings that are offered to you.

Before committing to any one company, research the coverage choices and discounts they provide to determine whether they are enough for the number of miles you go on the road.

- Compare the costs of several providers offering the same level of protection.

When you search around for vehicle insurance and get numerous quotes for the same coverage, you should be sure that the policies you compare are comparable. The next step is to examine and contrast the various premiums offered by various insurance providers.

Why Compare Insurance Companies Rates?

People can change their plans for several different reasons. It is your best to evaluate the programs first if you consider making any changes to how things are done. It is strongly suggested that you investigate the costs associated with each plan and the protections they provide before settling on the alternative that caters to your requirements the most effectively. When performing a Quotes comparison, the two most crucial factors to consider are the extent of coverage provided by each plan and the cost associated with that plan. The expenses and the range are allowed to shift within specific bounds, but only to a limited extent.

To Wrap Up

To save money you spend on auto insurance, comparison searching is essential. This is why: When it comes to determining premiums, insurers consider various factors, but each company has its own “special sauce.” Because of this, two separate businesses can charge completely different prices for the same offer.

When determining your premium, various insurance companies consider multiple aspects of your personal information. When it comes to pricing, every business uses its unique approach. Because of this, a single individual may receive insurance quotations for the same coverage from multiple firms that are substantially different from one another.

[/et_pb_text][/et_pb_column][/et_pb_row][/et_pb_section]